Hybrid Plans

Hybrid Plan Medical Coverage Overview

How Hybrid Plans Work

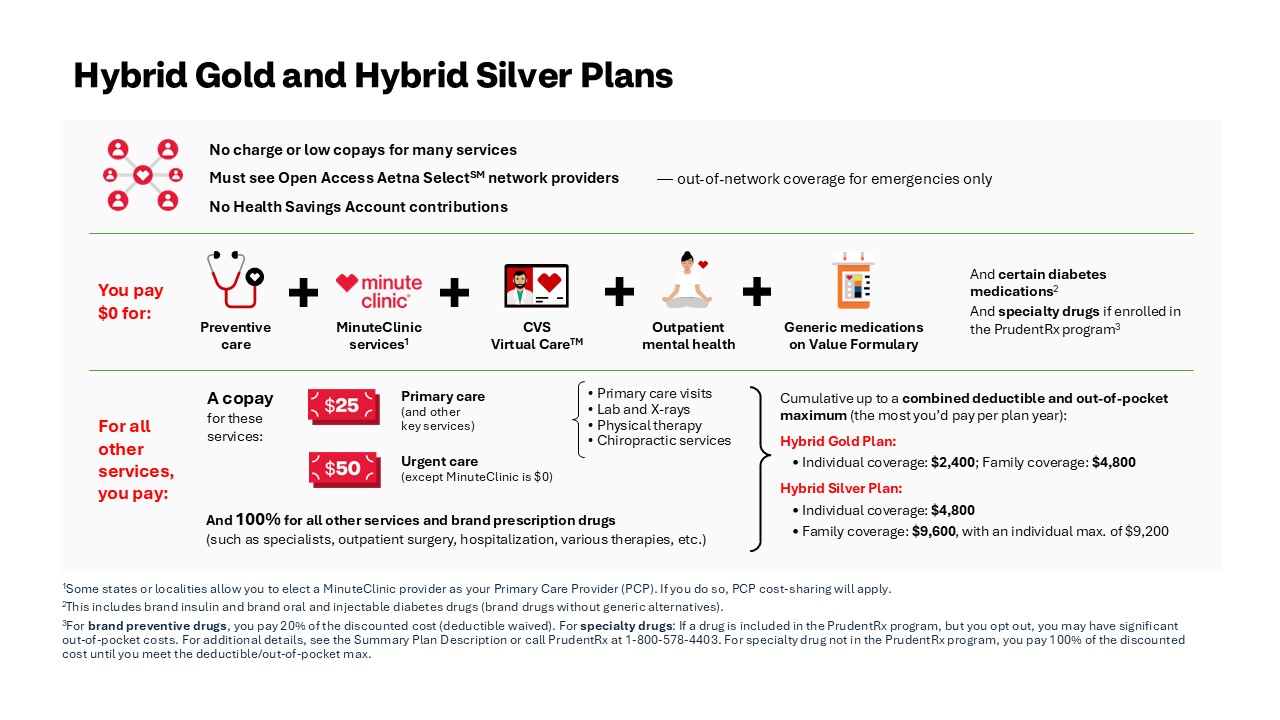

Hybrid Plans combine elements of Health Maintenance Organizations (HMOs) (copays, in-network coverage only) and combine them with elements of consumer-directed health plans (deductible/out-of-pocket maximum for certain services) to provide a high value plan with a lower paycheck cost.

Like HSP plans, in Hybrid plans preventive care is covered at 100%. In addition, many non-preventive medical services such as MinuteClinic Services, CVS Virtual Care™, Outpatient Mental Health visits, Generic Medications, certain diabetes drugs and most specialty medications are also covered at 100% ($0 copay). Many other common services including PCP sick visits, lab, x-rays, physical therapy, chiropractic visits and non-Minute Clinic urgent care ($50) are covered at a low copay ($25). Other services such as specialist care, hospitalization or brand prescriptions apply to the deductible, just like in HSP plans. Because the deductible and out-of-pocket maximum are combined in Hybrid plans, once you meet your deductible, your out-of-pocket maximum is also met, and CVS Health pays 100% of the cost of covered services.

Because of the non-preventive copays in the Hybrid Plan, these plans not a high deductible health plan as defined by the Internal Revenue Service (IRS) like the HSP options. This means that if you enroll in a Hybrid Plan, you cannot make or receive Health Savings Account (HSA) contributions. However, if you have a balance in an HSA, this account is yours and you may use funds in the account for eligible health care expenses including expenses in the Hybrid plan. If you like using a tax-advantaged account to pay for out-of-pocket expenses, you can enroll in a Health Care Flexible Spending Account (FSA) to pay for eligible health care expenses with Hybrid plans.

CVS Health offers two Hybrid Plans: Hybrid Gold and Hybrid Silver (offered to all colleagues and new hires). Hybrid Gold and Silver work exactly the same way, the only difference is the deductible/out-of-pocket maximum in the plans. Gold has lower plan limits, so it costs more in paycheck contributions.

-

Summary of Hybrid Plan Medical Coverage

Feature Hybrid Plan Option Annual Deductible/Out-of-Pocket Maximum For non-copay services, you pay 100% of the discounted cost until you reach the combined deductible/out-of-pocket maximum, then the plan pays 100%. Copays count towards the plan out-of-pocket maximum. For family coverage the entire deductible/OOP maximum must be met before the out-of-pocket maximum is met for any family member.

Annual Deductible/Out-of-Pocket Maximum

- Hybrid Silver Plan: $4,800 per individual / $9,600 family maximum ($9,200 Individual OOP limit)

- Hybrid Gold Plan: $2,400 per individual / $4,800 family maximum

Out-of-network

N/A

Coinsurance In-network

N/A

Out-of-network

N/A

Preventive Medical Care* CVS Health pays 100%, no deductible

Non-preventive Medical Care Office Visit — Primary Care Doctor

You pay $25 copay per visit

CVS Health Virtual Primary Care

CVS Health pays 100%, no deductible

Urgent Care Visits (Excluding MinuteClinic)

You pay a $50 copay

Laboratory Services (At an Independent Lab)

You pay a $25 copay

X-rays (Must be performed at a primary care doctor’s office or non-hospital facility)

You pay a $25 copay

Physical, Occupational and/or Speech Therapy

- Physical Therapy: You pay a $25 copay

- Occupational and/or Speech Therapy: CVS Health pays 100% after the deductible

Chiropractic Visits

Chiropractic Visits: You pay a $25 copay

Prescription Drugs (Value Formulary Through CVS Caremark)

Generic drugs: You pay nothing for preventive or non-preventive generic drugs on the CVS Caremark Value Formulary

Brand drugs: For Preventive Brand drugs on the CVS Value Formulary, you pay 20% of the discounted cost (deductible does not apply). For all other drugs on the CVS Caremark Value Formulary, You pay 100% of the discounted cost of the until you meet your combined deductible/out-of-pocket maximum. Once you meet your combined deductible/out-of-pocket maximum, CVS Health pays 100% of the cost for the rest of the plan year.

Specialty drugs:

- If your drug is on the Prudent Rx list and you enroll: You pay $0.

- If your drug is on the Prudent Rx list and you opt out of the program: you may have significant out-of-pocket costs. In addition, under the Affordable Care Act rules for Non-Essential Health Benefits, your share of the cost for most specialty medications will not apply to your combined deductible/out-of-pocket maximum (Hybrid Plan options). For additional details, see the Summary Plan Description or call PrudentRx at 1-800-578-4403.

See the “Prescription Drugs” drop-down below for more information

* Visit Aetna’s website to see a list of the preventive care services that your medical plan option will cover at 100% in-network, or call Aetna for information.

-

Hybrid Plans Prescription Coverage

Hybrid Plans Prescription Coverage

The Hybrid Plan option covers prescriptions on the Value Formulary through CVS Caremark.

About the Value Formulary

The Value Formulary promotes use of generics and select preferred brands and specialty medications.

Brand medications that have a generic alternative are not typically covered. For example, Crestor®, a brand name medication used to treat high cholesterol, is not covered. The generic Atorvastatin is covered at 100%.

Selected lifestyle medications (e.g., weight loss, smoking cessation and erectile dysfunction) are covered.

Generic Drugs

You pay nothing for all generic drugs — preventive and non-preventive — on the Value Formulary.

Brand Drugs

For Preventive Brand drugs on the Value Formulary, you pay 20% of the discounted cost (deductible does not apply). For non-preventive Brand drugs on the Value Formulary, you pay 100% of the full discounted cost out of your pocket until you reach your deductible/out-of-pocket maximum. Once your deductible/out-of-pocket maximum is met, the plan pays 100% for all brand drugs on the CVS Caremark Value Formulary.

The dollar amount you pay for a brand prescription drug will depend on the specific drug. To get the best value, use generics whenever possible. Note that some brand or other drugs may not be covered if other, more clinically effective medications are available.

Specialty Drugs

If your drug is on the Prudent Rx list and you enroll: You pay $0.

If your drug is on the Prudent Rx list and you opt out of the program: you may have significant out-of-pocket costs. In addition, under the Affordable Care Act rules for Non-Essential Health Benefits, your share of the cost for most specialty medications will not apply to your combined deductible/out-of-pocket maximum (Hybrid Plan options). For additional details, see the Summary Plan Description or call PrudentRx at 1-800-578-4403.

If the drug is not included in the PrudentRx program, once you meet your deductible, you pay $100 per prescription until you meet the annual out-of-pocket maximum.

Maintenance Drugs

If you take a generic maintenance drug, you may receive two fills with a 30-day supply; after that, you’re required to fill your maintenance drugs every 90 days. A CVS pharmacist will contact your prescribing doctor to update your maintenance drug prescription to a 90-day supply. You can pick up your maintenance drugs at a CVS Pharmacy or through mail order.

If you take a brand maintenance drug, you are required to fill your prescriptions with 30-day supply. You can pick up your maintenance drugs at a CVS Pharmacy or through mail order.

Check Drug Cost Tool

-

Hybrid Plans Provider Network

Hybrid Plans Provider Network

Hybrid Plans use the Open Access Aetna Select network in all locations. Open Access Aetna Select is a national network of quality providers. You can visit any doctor in the network — no referral needed. However, you need to see in-network providers for this plan to cover and help pay for care.

Find a Hybrid Plan In-Network Provider

To find doctors and other providers in an Aetna network, use the Aetna online provider directory or call 1-800-558-0860